Is QuickBooks Live Bookkeeping Right For Your Business?

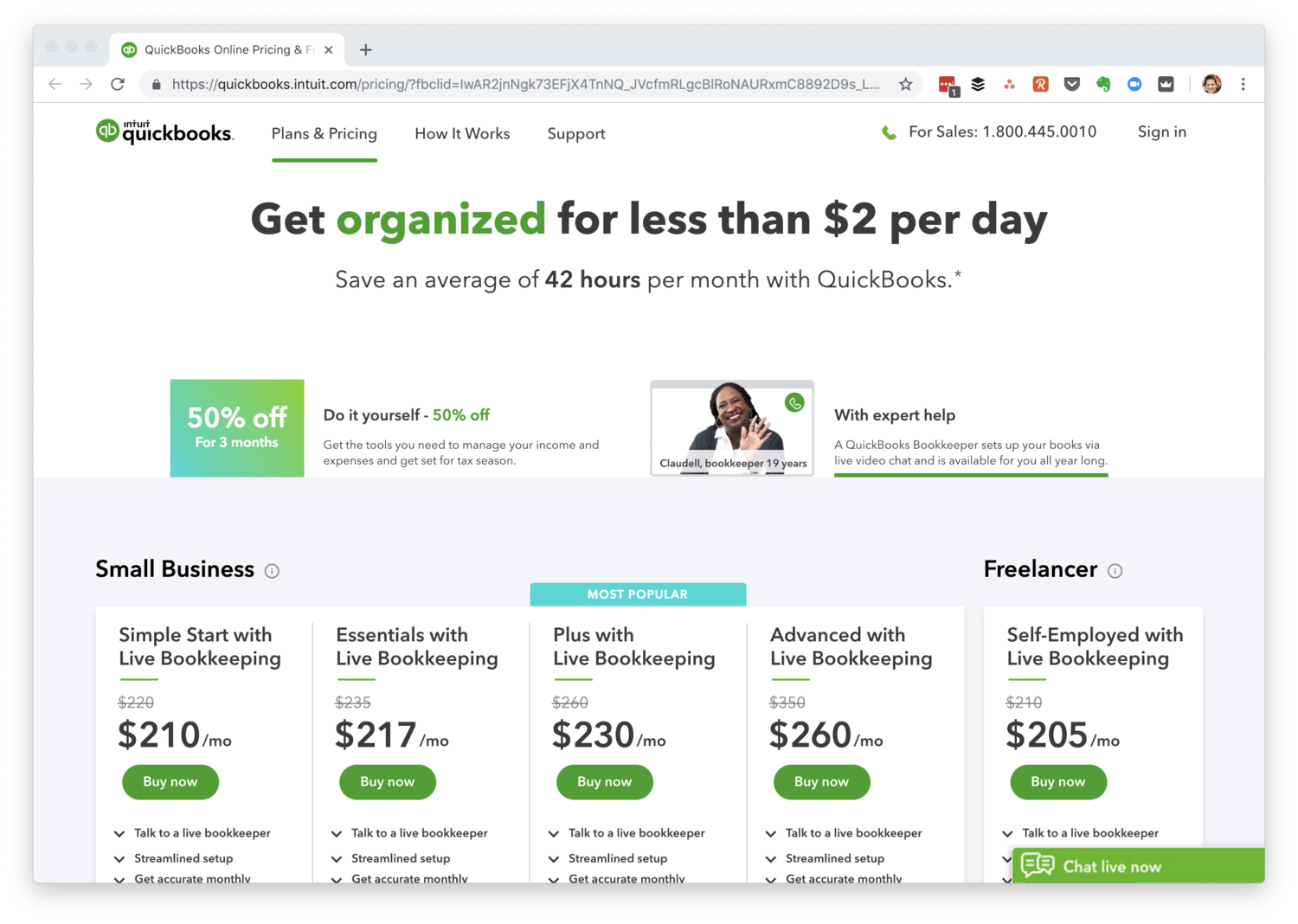

Intuit has a new featured add-on service for their QuickBooks Online product called QuickBooks Live Bookkeeping. It will be based on their very successful TurboTaxLive service that lets you talk to a real CPA or EA on demand for tax advice and final review of your tax return. A QuickBooks Bookkeeper sets up your books via live video chat and is available for you all year long.

No two businesses are alike.

I can see how TurboTaxLive would be very successful for users who need explanation of what TurboTax guides you through anyway, kind of like a confidence boost. But what is allowable as a tax deduction on a tax return is pretty cut and dry. There is only one tax form, the 1120S, for all businesses that file as an S Corporation.

However, not all businesses that are S Corps have the same processes, accounts, and bookkeeping needs. One may have just one checking account while another will have multiple checking and credit card accounts. Some may use a credit card for both personal and business expenses, although not recommended. Some may have fixed assets. Some may have complicated loans and investments. One size doesn’t fit all, which is why I don’t believe this service is scalable. It may work for the new entrepreneur, small business owner that is new to QuickBooks, but this would not be something that I think would work for an established, more complicated business. QBs Live Bookkeeping also won’t be available for QuickBooks Desktops users.

You Get What You Pay For.

As a Certified QuickBooks ProAdvisor, I have cleaned up many books that have been messed up by bookkeepers. And these are by the same people that either work part-time or full-time and on site or remotely. With QBs Live, you wouldn’t be able to have the same person every time you call. So you can imagine the time and frustration involved with having to explain the same complex situation to a different person each time.

There is no substitute for a qualified and trustworthy person working on your books. Intuit may use QuickBooks ProAdvisors that already provide bookkeeping services for this service, but why would one that is excellent at what they do undercut their own prices? And for those that aren’t ProAdvisors, will they have certifications? Will they have background checks? I can’t imagine a CPA, who makes the highest rate in the accounting business, resorting to the lowest rate, lower than what a professional bookkeeper would charge.

Do What is Best for the Success of Your Business.

QuickBooks Online has been a game-changer for my business. With access anytime, anywhere, it has allowed me to proactively work with my clients. Instead of them contacting me only when they have discovered a problem, I monitor their accounts and provide regular reviews of their financials to prevent issues from becoming major and to eliminate surprises for their CPA or tax preparer at tax time.

It has also allowed me to add apps and other valuable services. Running a successful business isn’t just about having books that are correct. There are so many other cogs in the wheel: eCommerce, payroll, receipt capture, and business intelligence reporting and consultation. Providing all of these for a fixed, monthly price is a win-win. QBs Live Bookkeeping may be the right fit for a new business with simple needs, but not for more complex businesses or ones whose books need major cleanup.