Why Hiring a Bookkeeper (Like Me, a ProAdvisor!) is Crucial for Small Businesses

Running a small business is no small feat. Between managing clients, handling operations, and growing your brand, bookkeeping might seem like just another task on your already packed to-do list. Many small business owners attempt to manage their own books, but doing so can lead to costly mistakes, missed tax deductions, and lost time that could be better spent growing the business.

As a QuickBooks ProAdvisor and professional bookkeeper, I understand the complexities of small business finances and am here to help you stay organized, compliant, and stress-free. Here’s why hiring a bookkeeper like me is one of the best investments you can make for your business.

1. Save Time and Focus on Growth

Every hour you spend reconciling accounts or categorizing expenses is an hour you’re not spending on growing your business. Bookkeeping is time-consuming, especially if you're not familiar with best practices and financial software. By hiring a professional, you free yourself to focus on the areas where you excel—whether that's serving clients, marketing your products, or developing new ideas.

2. Reduce Costly Errors

Incorrect data entry, missing transactions, and unbalanced books can lead to financial headaches, penalties, and inaccurate tax filings. A bookkeeper ensures your records are accurate, reducing the risk of costly errors and giving you peace of mind that your finances are in order.

3. Maximize Tax Deductions and Stay Compliant

Tax season can be stressful, but a well-maintained set of books can make all the difference. As a bookkeeper, I keep track of deductible expenses and ensure your records are IRS-compliant. This means you won’t miss valuable deductions or risk penalties due to inaccurate reporting.

4. Gain Financial Insights for Smarter Decision-Making

Understanding your financial position is crucial for making informed business decisions. A bookkeeper provides you with clear financial reports, cash flow analysis, and budgeting assistance, giving you the knowledge you need to scale and manage your business efficiently.

5. Seamless QuickBooks Integration and Optimization

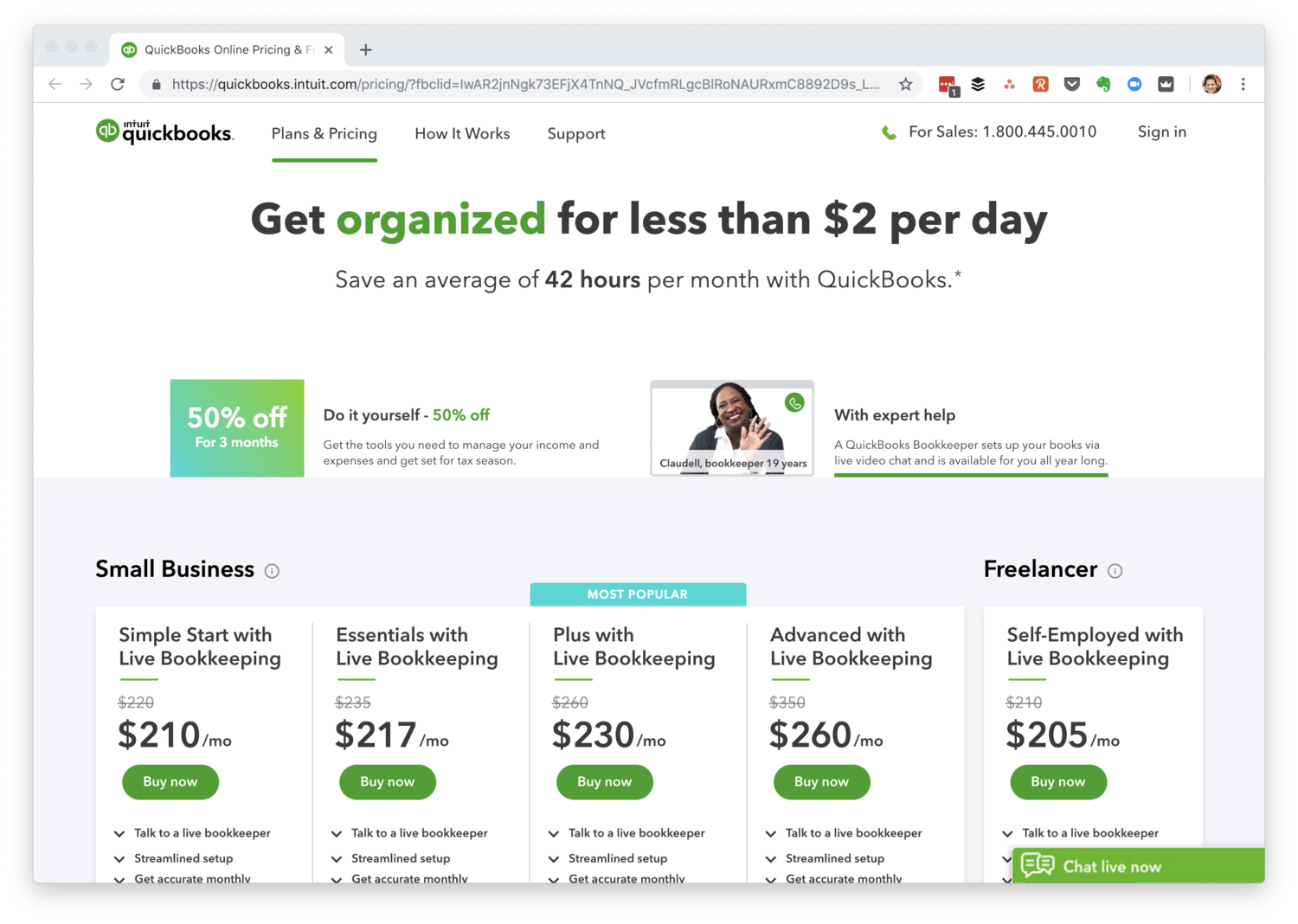

As a QuickBooks ProAdvisor, I not only keep your books organized but also optimize QuickBooks for your specific needs. I can help set up automated workflows, customize reports, and ensure you’re using the software to its full potential—saving you both time and frustration.

6. Avoid the End-of-Year Rush

Scrambling to get your books in order right before tax season is overwhelming. A bookkeeper keeps everything up to date throughout the year, making tax filing smooth and stress-free.

7. It’s More Affordable Than You Think

Many small business owners assume hiring a bookkeeper is a luxury they can’t afford. In reality, the cost of bookkeeping services is often outweighed by the money saved in tax deductions, financial clarity, and time that can be reinvested into the business.

Let’s Get Started!

If you’re ready to take bookkeeping off your plate and gain financial clarity, I’d love to help! As a QuickBooks ProAdvisor, I offer expert bookkeeping services tailored to your business’s unique needs. Contact me today, and let’s work together to keep your business’s finances on track!